Demonstrate your knowledge of investment companies

Learn about discounts and premiums, gearing and the unique income features of investment companies, also known as investment trusts.

It’s simple to get started…

Complete four 45-minute online courses to achieve the Investment Company Accreditation, a certificate that demonstrates your knowledge and competence in investment companies.

Participating in the Investment Company Accreditation is open to all finance professionals and is free of charge. The Accreditation is offered by the Association of Investment Companies (AIC), the industry body for investment companies and investment trusts.

Sign up to start accreditation

Why complete the Investment Company Accreditation?

- It's completely free and takes less than a minute to sign up.

- Demonstrate your knowledge of investment companies to clients and peers.

- Achieve recognition from the industry body for investment companies.

- Take the four courses at any time, on different days, to fit your schedule.

- Earn up to three hours CPD, accredited by the CII and the CISI.

Finance professionals only

Are you accredited yet?

Find out how the Investment Company Accreditation can help you demonstrate your competence while earning CPD.

Complete these four courses to earn the Accreditation

An introduction to investment companies

Start here to brush up on the basics of investment companies (a.k.a. investment trusts).

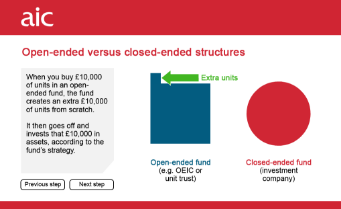

- Identify the similarities and differences between investment companies and open-ended funds

- Describe the key risks of investment companies

- Explain the main benefits of investment companies

Discounts and premiums

What are the implications of discounts and premiums for an investor?

- Explain how the discount or premium of an investment company is calculated

- Identify the main factors affecting the discount or premium of an investment company

- Describe the implications for an investor of investment companies' discounts and premiums

Gearing

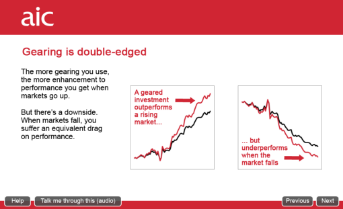

Understand the different types of gearing, its risks and benefits.

- Describe and quantify the benefits and risks of gearing

- Summarise how investment companies use gearing, including the different forms of gearing they may use

- Be able to assess whether an investment company’s approach to gearing is suitable for a given client

The income features of investment companies

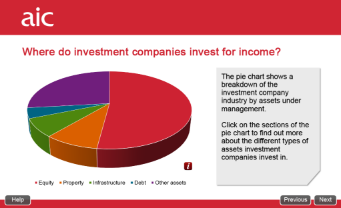

Learn how investment companies generate and distribute income.

- Describe the structural differences between investment companies and open-ended funds that relate to their ability to generate and distribute income

- Explain how the revenue reserve of an investment company works

- Be able to research and select suitable income-generating investment companies for clients with various objectives

Developed by Moore-Wilson