The direction of travel

The surge in momentum behind responsible investing continues to accelerate as the finishing touches are being made to a number of regulatory proposals likely to have a fundamental impact on the financial advice process. Ultimately, asking your clients and responding to their sustainability preferences is going to become a mandated and core component of financial planning at some point.

Preparation and education are vital

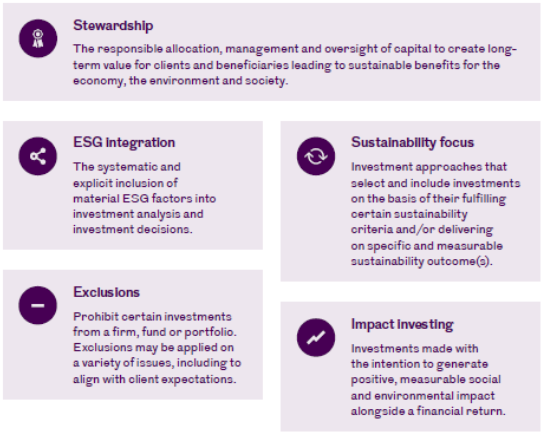

There's so much noise around responsible investment, but how do you prepare and start to engage with your clients in this area? Responsible investment is littered with buzz words and acronyms and understanding all this alphabet spaghetti should be the beginning of your journey. A sensible starting point is familiarising yourself with the Investment Association's (IA) framework. It outlines and defines the opposite responsible investment approaches. Familiarising yourself with these terms and what they actually mean will allow you to clearly communicate with your clients in an honest and more consistent manner. Solving this terminology puzzle is an essential pre-requisite to any client conversation in this area.

Learning resources

There's a wide range of educational resources to tap into and strengthen your overall understanding of responsible investing.

You'll find some excellent resources on the UNPRI website including guides, case studies and webinars. The MSCI website has lots of free content including ESG rankings for funds and other tools.

PIMFA launched its ESG Academy, which is a great resource for self-learning, as is the CFA 'certificate in ESG investing' which aims to deliver the benchmark knowledge and skills required to embed ESG factors into the investment process.

In addition, there's also an increasing amount of research papers readily available too which explore the issues in this field. For example, EY & Royal London have published a recent study which explores the various empirical evidence linking ESG considerations to corporate financial performance.

There's no silver bullet for research resources and this isn't something that can be easily outsourced. A strong sense of ownership is needed in this area, particularly to engage your clients.

Client engagement

Before just throwing in some additional questions into your client fact finds, it may be more beneficial to warm your clients up and engage with them on responsible investment themes. This will allow you to flesh out client interests and motivations at an early stage in the advice journey.

Certain events in 2020 have presented a unique opportunity to engage with clients on a number of different ESG issues. Equally, the 17 inter-connected goals of the UN's Sustainable Development Goals framework can provide you with a sensible starting point for approaching prominent meta-trends such as climate change.

The next UN climate change conference take place in Glasgow this November with the UK assuming presidency at COP26. The drumbeat around this event has started to build and will only get louder in the coming weeks, presenting a great opportunity to engage with clients on environmental concerns. It doesn't have to be anything sophisticated, it's about sensing your clients' needs from a responsible investment angle before formally integrating into your standard fact finding processes.

To see how we can help you with your client conversations on responsible investment visit adviser.royallondon.com